Commonly used terminology

Accident

A sudden, short-term external event, which results in the damage or destruction of the insured object.

Actual Loss

Actual loss is a term that your insurance representative or claims adjuster may use when referring to how much money has been paid out by the insurance company on behalf of the damage caused to the insured object by the insured perils in a claim.

Beneficiary

A person, who is entitled to an insurance compensation, in case of an insurance event.

Conditional Deductible

The insurer is released from the obligation to pay the insurance indemnity if the amount of damage caused as a result of the insurance accident does not exceed or is equal to the amount of deductible specified in the Contract.

Damage Assessor

A licensed professional, who assesses the damage done to the insured object as a result of an insurance event.

Deductible

The deductible is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses.

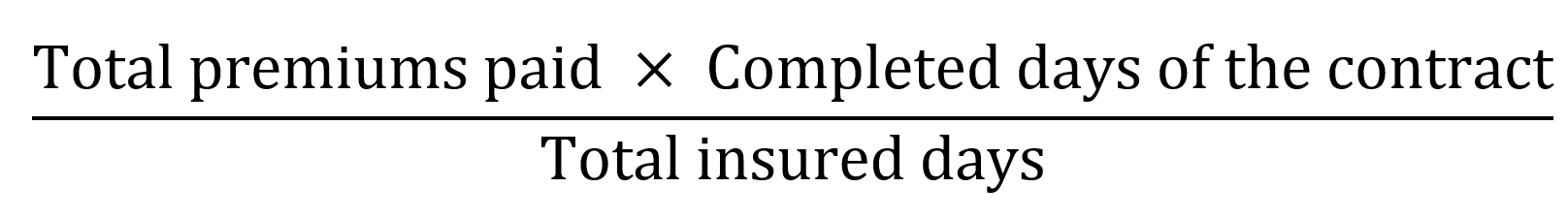

Earned Insurance Premiums

Full Coverage Insurance

When the Insured Sum is equal to the market value of the Insured Object.

General (Non-life) Insurance

Insurance contracts that are not included in the definition of life insurance are considered as general or non-life insurance.

Insurance Agent

A person registered in the register of insurance agents of the Central Bank for carrying out the activity of an insurance agent in the territory of the Republic of Armenia.

Insurance agent activity

Carrying out insurance intermediation activities at the expense and on behalf of one or several insurance or reinsurance companies.

Insurance intermediation activities

The term ‘insurance intermediation’ includes both concluding insurance contracts as well as offering insurance contracts, acting either on behalf or in the interest of an insurance undertaking or on behalf or in the interest of another person.

Insurance Broker

Commercial organization licensed to carry out insurance brokerage activity in the territory of the Republic of Armenia.

Insurance Compensation

The amount paid by an insurance company to the insured when covered damages occur.

Insurance Coverage Area

Insurance coverage area refers to the geographic region in which an insurance policy’s benefits apply.

Insurance Event

An event, which according to the Insurance Policy would cause an insurer to pay a claim.

Insurance Object

The object of insurance is the property-personal interests subject to insurance.

Insurance Premium

Premium is an amount paid periodically to the insurer by the insured for covering his risk.

Insurance Risk

The likelihood that an insured event will occur, requiring the insurer to pay a claim.

Insurance Sub-limit

A limitation in an insurance policy on the amount of coverage available to cover a specific type of loss.

Insured Person

The insured person is the person with whom the occurrence of an accident covered by the policy is the subject of an insurance accident.

Insured Sum

The insured sum indicates the maximum amount paid out by the insurer in the event of a claim.

Insured Value

In case of a physical object insurance, the market value of the insured object.

Insurer

Insurance company, or a branch of an international insurance company, providing insurance service in Armenia.

Life Insurance

Type of insurance contract, in which case the insurer is obliged to compensate the beneficiaries in case of death of the insured.

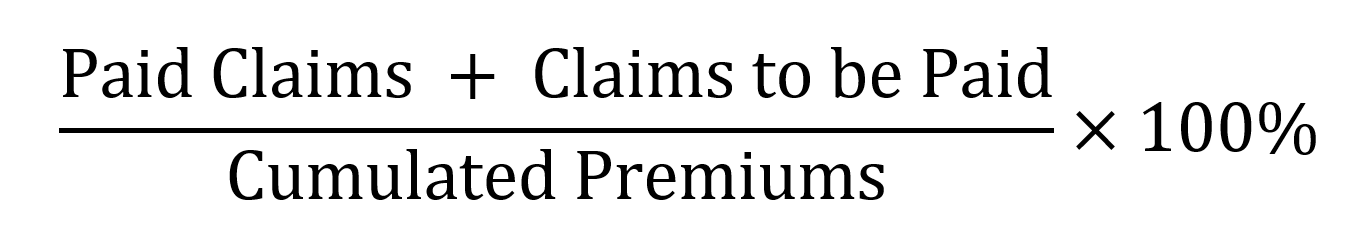

Loss Ratio

Non Conditional Deductible (Lump Sum)

The insurer is exempted from paying the insurance indemnity in the amount of the deductible defined in the Contract (the insurance indemnity is reduced by the amount of the deductible).

Non-proportional insurance

When the sum insured can be set at the maximum of the market value of the object of insurance, but the ratio of the insurance value to the insurance amount is not taken into account during a compensation. Within the limits of the sum insured, all the damage caused to the object of the insurance is reimbursed except for the amount of the deductible.

Partial non-proportional insurance

When the sum insured is less than the market value of the object of insurance, in which case the damage is partially compensated in proportion to the ratio of the sum insured to the market value.

Policy Holder

Physical or legal entity, which has signed an Insurance contract with an Insurer.

Subrogation

Subrogation is a term describing a right held by most insurance carriers to legally pursue a third party that caused an insurance loss to the insured. This is done in order to recover the amount of the claim paid by the insurance carrier to the insured for the loss.

Victim

Persons who are entitled to compensation for damage caused to their life, health or property as a result of an insurance accident, as well as the loss of a breadwinner, funeral expenses, in accordance with the legislation of the Republic of Armenia.

Damage

A combination of insurance risks in the selected rules.

Declaration of Agreement

It is a document that the parties of an insurance accident can fill out in order to expedite the compensation process, as well as not to involve the Traffic Police or an insurance agent. The declaration can be applied if one of the parties admits his guilt and the damage caused by the accident does not exceed 200,000 AMD while in Yerevan, and 100,000 AMD outside of Yerevan.

Motor insurers’ bureau of Armenia

A state-recognized self-regulatory organization whose goals are to protect the interests of victims, as well as to ensure the stability and development of the CMTPL system.

VIN Number

A Vehicle identification number (VIN) (also called a Chassis number or Frame number) is a unique code, including a serial number, used by the automotive industry to identify individual motor vehicles, towed vehicles, motorcycles, scooters and mopeds, as defined in ISO 3779 (content and structure) and ISO 4030 (location and attachment).

Authorized Driver

A natural person who has the right to drive the insured vehicle under the insurance contract in accordance with the procedure defined by the RA legislation.

Road Vehicle

A vehicle, which is powered by an engine and is designed to legally carry people or cargo on public roads and highways such as busses, cars, trucks, vans, motor homes, and motorcycles. It must also have an engine volume exceeding 50 cubic cm, or have a top speed which exceeds 50 km/h.

Traffic Accident

A traffic collision, also called a motor vehicle collision, car accident, or car crash, occurs when a vehicle collides with another vehicle, pedestrian, animal, road debris, or other stationary obstruction, such as a tree, pole or building.

Ambulatory treatment

Every treatment which is not stationary is considered as ambulatory.

Day Stationary

Day stationary service is a therapeutic or diagnostic service, where treatment and health care for patient is provided not full day and night, but requires monitoring of patient after the manipulation (procedure) for at least three hours in a day.

Emergency medical care

Medical care provided in case of sudden acute life-threatening diseases, conditions, chronic diseases, life-threatening exacerbations, which at that time require urgent medical intervention.

Scheduled medical care

Medical care provided in advance in the event of an illness or condition that is not currently life-threatening, non-urgent, or which does not result in a temporary deterioration in the patient’s condition, health or life-threatening condition.

Stationary treatment

In order to be considered as stationary, a patient must have being cared for at least 24h in a hospital. The care time does not always include waiting time in emergency department.

Urgent Medical Care

Medical care provided in case of sudden acute illnesses, conditions, exacerbations of chronic diseases with no obvious signs of danger to life, which at the moment have no obvious signs of danger to the patient’s life.

Insured Harvest

Crop specified in the insurance contract, which is grown by the Insured or the lessee.

NAAI

“National Agency of Agricultural Insurers” public organization.

Production Cost

Total costs of planting, seedlings, fertilizers, fuel, pesticides, irrigation, labor costs, and other costs of growing the crop.

Market regulation

“INGO ARMENIA” ICJSC

Website: www.ingoarmenia.am

Founded: 1997

Shareholders: “InVest-Polis” JSC 75.00%; Levon Altunyan 25.00%

Gross written premiums (2019): 13,367 mln AMD

Net income (2019): 270 mln AMD

Total assets (2019): 13,522 mln AMD

Total equity (2019): 4,368 mln AMD

“ROSGOSSTRAKH-ARMENIA” ICJSC

Website: www.rgs.am

Founded: 2008

Shareholders: “Avodoka Holdings Limited” LLC 100.00%

Gross written premiums (2019): 13,181 mln AMD

Net income (2019): 123 mln AMD

Total assets (2019): 17,125 mln AMD

Total equity (2019): 7,008 mln AMD

“RESO” ICJSC

Website: www.reso.am

Founded: 2008

Shareholders: “Polygraphy” CJSC 50.00%; “CIS Equity Partners Limited” LLC 50.00%

Gross written premiums (2019): 4,689 mln AMD

Net income (2019): 150 mln AMD

Total assets (2019): 4,778 mln AMD

Total equity (2019): 3,346 mln AMD

“ARMENIA INSURANCE” LTD

Website: www.armeniainsurance.am

Founded: 2004

Shareholders: “Region Financial Industrial Corporation” CJSC 95.04%; “Ardshinbank” CJSC 4.96%

Gross written premiums (2019): 3,592 mln AMD

Net income (2019): 300 mln AMD

Total assets (2019): 12,300 mln AMD

Total equity (2019): 2,924 mln AMD

“SIL INSURANCE” ICJSC

Website: www.silinsurance.am

Founded: 2000

Shareholders: Khachatur Sukiasyan 25.00%; Saribek Sukiasyan 25.00%; Eduard Sukiasyan 25.00%; Robert Sukiasyan 25.00%

Gross written premiums (2019): 5,171 mln AMD

Net income (2019): (126) mln AMD

Total assets (2019): 4,561 mln AMD

Total equity (2019): 1,626 mln AMD

“NAIRI INSURANCE” LLC

Website: www.nairi-insurance.am

Founded: 1996

Shareholders: Levon Kocharyan 60.00%; Vahagn Khachatryan 40.00%

Gross written premiums (2019): 7,449 mln AMD

Net income (2019): 435 mln AMD

Total assets (2019): 9,403 mln AMD

Total equity (2019): 2,749 mln AMD

“Export Insurance Agency of Armenia” ICJSC

Website: www.eia.am

Founded: 2013

Shareholders: Ministry of Economy of the RA 100.00%

Gross written premiums (2019): 114 mln AMD

Net income (2019): 79 mln AMD

Total assets (2019): 3,490 mln AMD

Total equity (2019): 2,346 mln AMD

“PRIME” Insurance Brokers LTD

Website: www.prime-insurance.am

Founded: 1997

Shareholders: Artavazd Yakhshibekyan 50.00%; Samvel Hakobyan 50.00%

Revenue (2019): 65 mln AMD

Net income (2019): 5 mln AMD

Total assets (2019): 142 mln AMD

Total equity (2019): 52 mln AMD

“RESOLUTION” Insurance Brokers LTD

Website: www.recon.am

Founded: 2000

Shareholders:

Revenue (2019): 113 mln AMD

Net income (2019): 66 mln AMD

Total assets (2019): 178 mln AMD

Total equity (2019): 71 mln AMD

“Crescent Global Eurasia” Insurance and Reinsurance Broker CJSC

Website:

Founded: 2015

Shareholders:

Revenue (2019):

Net income (2019):

Total assets (2019):

Total equity (2019):

“Agricultural Reinsurance Broker” LLC

Website:

Founded: 2019

Shareholders:

Revenue (2019):

Net income (2019):

Total assets (2019):

Total equity (2019):

Central Bank of Armenia

Regulator of RA financial sector, also the regulatory body of the insurance system. Supervises the activities of insurance companies.

Main function: Licensing of insurance companies, setting standards, control, regulation.

Founded: 2006

Website: www.cba.am

ABC Finance

Created by the Central Bank of Armenia to help educate the public in financial matters.

Main function: Publication of information materials, public awareness and educational events.

Founded: 2009

Website: www.abcfinance.am

Financial System Mediator

The mediator is called to resolve disputes between individuals or legal entities and financial organizations on a free basis.

Field of control: Insurance companies, banks, credit companies այլ other financial market participants.

Founded: 2009

Website: www.fsm.am

Armenian Motor Insurance Bureau

The Bureau is the regulatory body supervising and regulating the CMTPL sector in the RA.

Main function: Control of the CMTPL system in the RA, elaboration of the CMTPL fundamental rules, establishment of tariff policy, protection of the interests of the injured persons.

Founded: 2010

Website: www.appa.am

“National Agency of Agricultural Insurers” NGO

Coordinating agency supporting the agro-insurance system.

Main function: Control of the Agro-Insurance System in the RA, elaboration of fundamental rules, establishment of tariff policy, protection of the interests of the injured persons.

Founded: 2019

Website: www.aina.am