During the first nine months of 2025, EFES Insurance CJSC demonstrated stable and consistent growth, maintaining its leading positions in both the general and voluntary insurance markets. The company continued to develop its EFES Online platform and enhance its mobile application, making insurance services even more accessible and convenient.

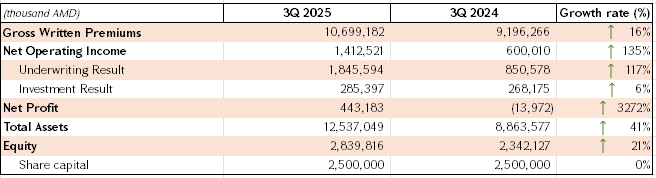

Key Financial Indicators

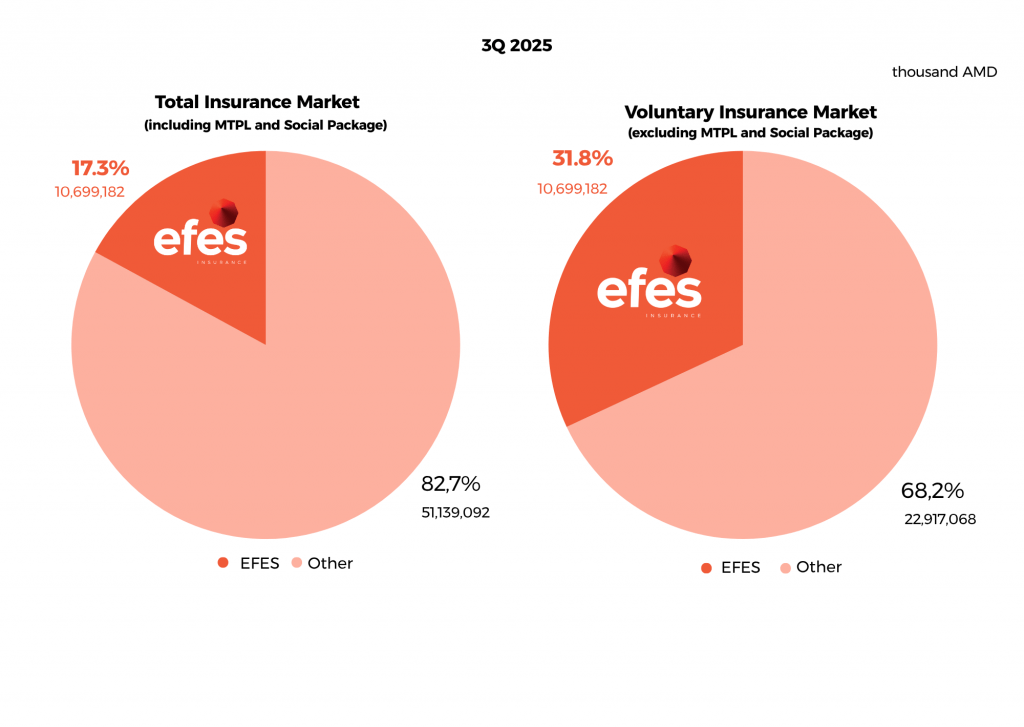

- As of the 9 months of 2025, the company’s insurance premium portfolio increased by 16% compared to the same period last year, reaching AMD 10.7 billion.

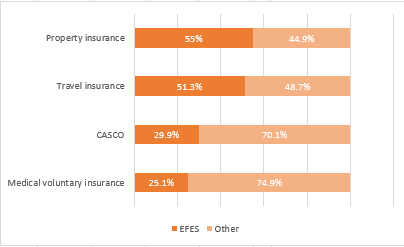

- The structure of the insurance portfolio is primarily composed of:

- Property insurance: over AMD 3.9 billion

- Health insurance: AMD 3.8 billion

- Voluntary motor insurance (CASCO): nearly AMD 1.6 billion

- Based on the 9-month results for 2025, the company confidently holds the leading position both in the voluntary insurance market (31.8% share) and in the overall insurance market (17.3% share).

- Compared to the same period last year, the company’s total assets grew by 40%, amounting to AMD 12.5 billion.

- Net investment income totaled AMD 285.4 million, with an investment portfolio return (ROI) of 11.8% and an asset return (ROA) of 5.5%.

- The capital adequacy ratio stood at 1.68, remaining within a safe and stable range.

Table: Key Operating Indicators for Q3 2025 Compared to the Equivalent Period Last Year

Statement from Arevshat Meliksetyan, CEO of EFES ICJSC:

“The year 2025 continues to be one of stable growth and innovation for EFES. Our goal is to make insurance more accessible, convenient, and beneficial for every customer. Through the introduction of digital solutions and continuous improvement of our services, we enhance customer experience while strengthening trust in the company. We highly value the teamwork and partnership that enable EFES to maintain its leadership in the voluntary insurance market, remaining faithful to our principle — ‘It’s all about you’.”

Leading insurance segments in the market, by insurance premiums

EFES insurance company is one of Armenia’s leading voluntary insurance providers. Established in 2023, the Company brings a creative approach to the Armenian insurance market, offering digital solutions and high-quality services. EFES collected AMD 11.8 billion in insurance premiums in 2024. With a team of over 200 experienced professionals, it serves approximately 170,000 clients annually. The Company is actively expanding its international partnerships, ensuring modern and affordable insurance solutions for its customers. EFES’ mission is: ‘to empower individuals and society to focus on the positive and creative aspects of life.

IT’S ALL ABOUT YOU

Press release related questions: [email protected]