2025 started with steady growth for EFES ICJSC, strengthening its position as the leader in voluntary insurance in Armenia. The Company continues to grow, driven by exceptional customer service, the introduction of innovative products, and enhancement of digital solutions.

Key Financial Achievements of the Company

- Gross Written Premiums (GWP) amounted to AMD 5.1 billion, a 2% increase compared to the comparable period of the previous year.

- Within the insurance premium portfolio, property insurance holds a significant volume of nearly AMD 2.5 billion, followed by voluntary health insurance at AMD 1.8 billion, and motor (CASCO) insurance at AMD 0.4 billion.

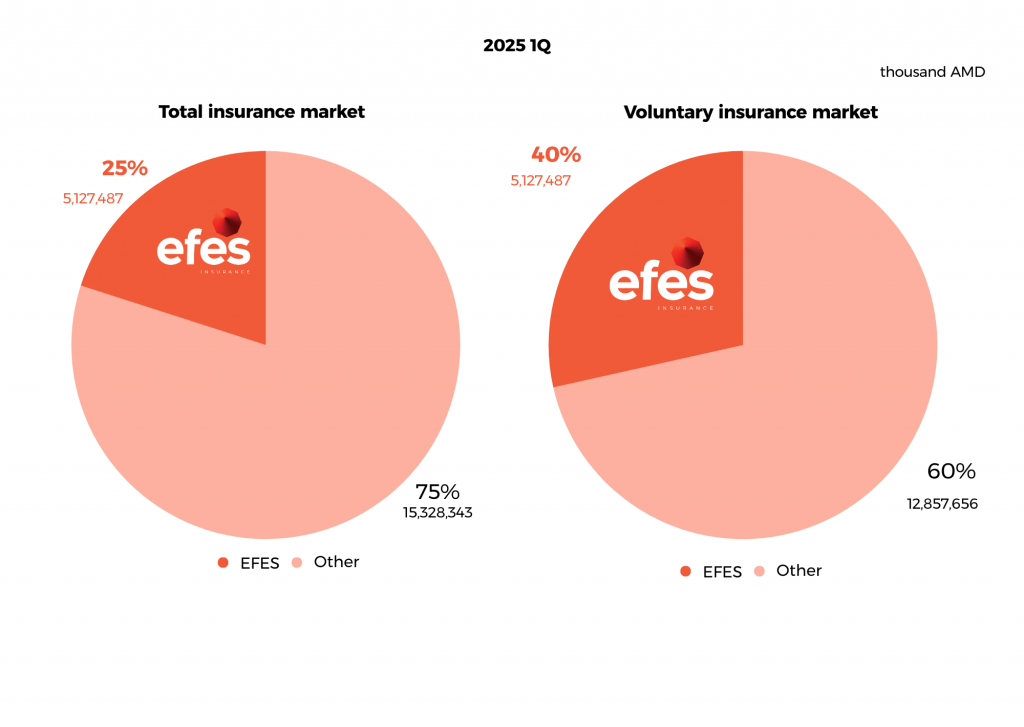

- In terms of written premiums in the first quarter of 2025, the Company confidently holds a leading position both in the total insurance market (25.07% share) and in the voluntary insurance market (39.88% share). The Company does not participate in compulsory insurance lines (CMTPL and the Social Package).

- Compared with the corresponding period of the previous year, the Company’s total assets have almost doubled, amounting to AMD 11.5 billion.

- The net investment result reached AMD 91.7 million, with an investment portfolio return of 11.4%.

- The capital adequacy ratio stood at 1.48 and is within a safe and stable range.

Compared to the first quarter of the previous year, the Company improved all its operating indicators, including insurance and investment results, assets, equity, and net profit.

Table․ Key operating indicators for the first quarter of 2025 compared to the first quarter of the previous year

| (thousand, AMD) | 2025 | 2024 | Աճի տեմպ (%) |

| Gross Written Premiums | 5,127,487 | 5,008,331 | 2.40% |

| Net Operating Income | 632,604 | 261,058 | 142.30% |

| Underwriting Result | 535,336 | 174,885 | 206.10% |

| Investment Result | 87,533 | 86,173 | 12.90% |

| Net Profit | 139,267 | (16,501) | 944.00% |

| Total Assets | 11,449,538 | 5,805,850 | 97.20% |

| Equity | 2,512,307 | 2,342,127 | 7.30% |

| Share capital | 2,500,000 | 2,000,000 | 25.00% |

Statement from Arevshat Meliksetyan, CEO of EFES ICJSC:

«The results of the first quarter of 2025 reaffirmed the effectiveness of the EFES ICJSC team’s consistent efforts and the power of its strategic vision. We believe that insurance should be accessible, simple, and convenient for every citizen. Our efforts are centered on creating an environment of trust, where people can focus on life’s positive and creative pursuits. In the coming quarters, EFES insurance company will focus on the development of its digital platforms, including the mobile application and website functionalities, as well as the introduction of the customer loyalty program.»

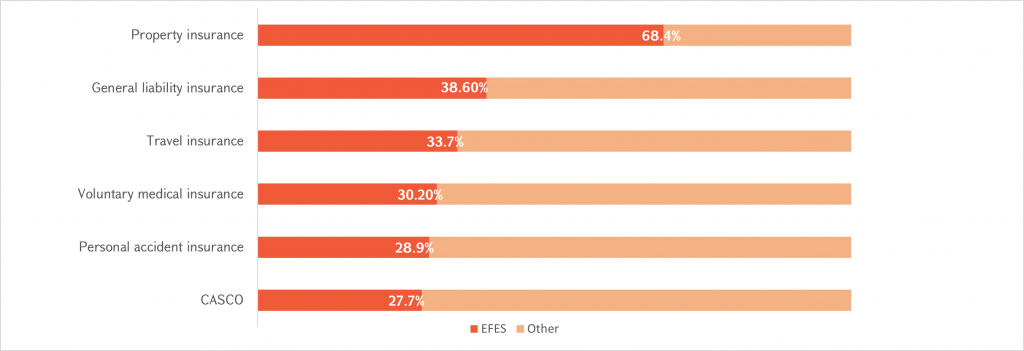

Leading insurance segments in the market

The Company maintains a leading position in the market across multiple insurance segments. In particular, EFES dominates the property and liability insurance markets (68.4% and 38.6%, respectively). The Company also holds a significant market share in voluntary medical, travel, accident, and motor (CASCO) insurance lines.

EFES insurance company is one of Armenia’s leading voluntary insurance providers. Established in 2023, the Company brings a creative approach to the Armenian insurance market, offering digital solutions and high-quality services. EFES collected AMD 11.8 billion in insurance premiums in 2024. With a team of over 200 experienced professionals, it serves approximately 170,000 clients annually. The Company is actively expanding its international partnerships, ensuring modern and affordable insurance solutions for its customers. EFES’ mission is: ‘to empower individuals and society to focus on the positive and creative aspects of life.

IT’S ALL ABOUT YOU

Press release related questions: [email protected]