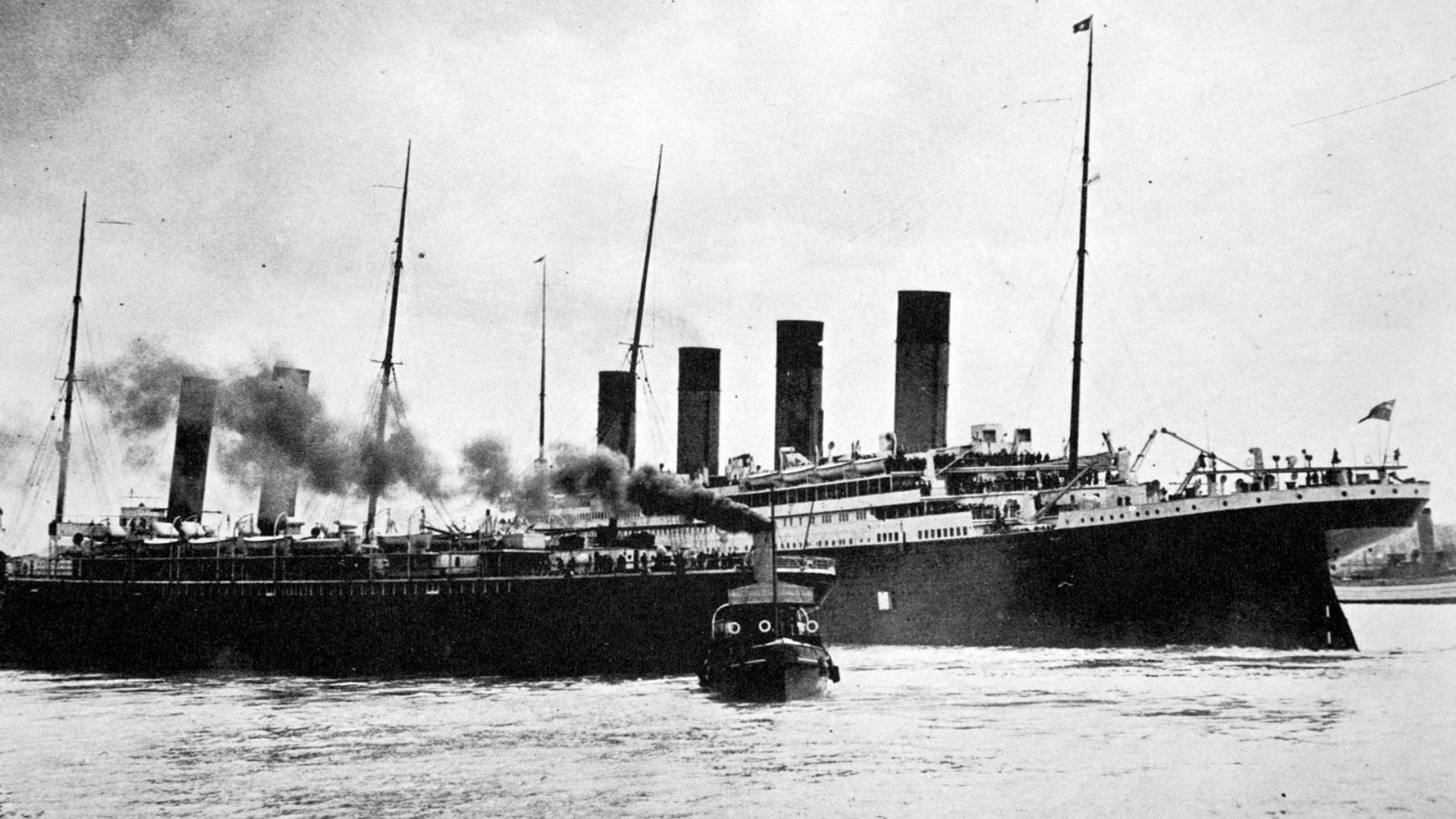

While all our hearts pour over the death of Leonardo DiCaprio at James Cameron’s Titanic movie, the story stays one of the biggest catastrophes the humanity even faced. Killing more than 1,500 people, the unsinkable ship, Titanic was forever imprinted in the history and insurance narrative.

On the January of 1912, Broker Willis Faber & Co came to Lloyd’s to insure the vessel and her sister ship, the Olympic, on behalf of the White Star Line. In just 2 days, the slip was complete with myriad of underwriters taking portions of the risk ranging from £200 to £75,000. The full insurance amounted £1m for each ship, which is over $120m in today’s money.

The Titanic sunk on 14 April. However, at the time market received conflicting news. While some people believed that the ship survived and was being towed to the near port, others were more skeptical and began to trade ‘overdue insurance’ (sale of their liability if uncertain news was received). When the final reports came in, it showed that more than half the ship’s passengers and crew had died.

Provided the financial strength of Lloyd’s market, White Star was paid in full within a month after the accident. This constitutes one of the market’s biggest insurance claims ever, along with the loss of HMS Lutine, 9/11, ’05 hurricanes, etc.

SOURCE – https://www.lloyds.com/about-lloyds/history/catastrophes-and-claims/titanic